Fintech

Transform Your Fintech Venture: Pitch Decks, Market Research, and Financial Solutions

Expert Guidance Tailored to Your Fintech Needs

Welcome to our Fintech industry page, where we specialize in providing customized pitch decks, market research, financials, and more to help your business thrive in this competitive space. With our wealth of experience and knowledge, we understand the unique challenges and opportunities that the fintech industry presents for entrepreneurs.

The Fintech industry is characterized by disruptive technologies, changing customer expectations, and regulatory hurdles. As a result, crafting a persuasive pitch in this industry demands a deep understanding of technological innovations, market trends, and compliance requirements. Additionally, the increasing importance of cybersecurity and data privacy adds layers of complexity to this dynamic market.

Our team of experts is equipped with the skills and insights to support entrepreneurs in the fintech sector. By working closely with our clients, we develop tailored solutions that not only address the unique nuances of this industry but also position their businesses for long-term success.

Our services include:

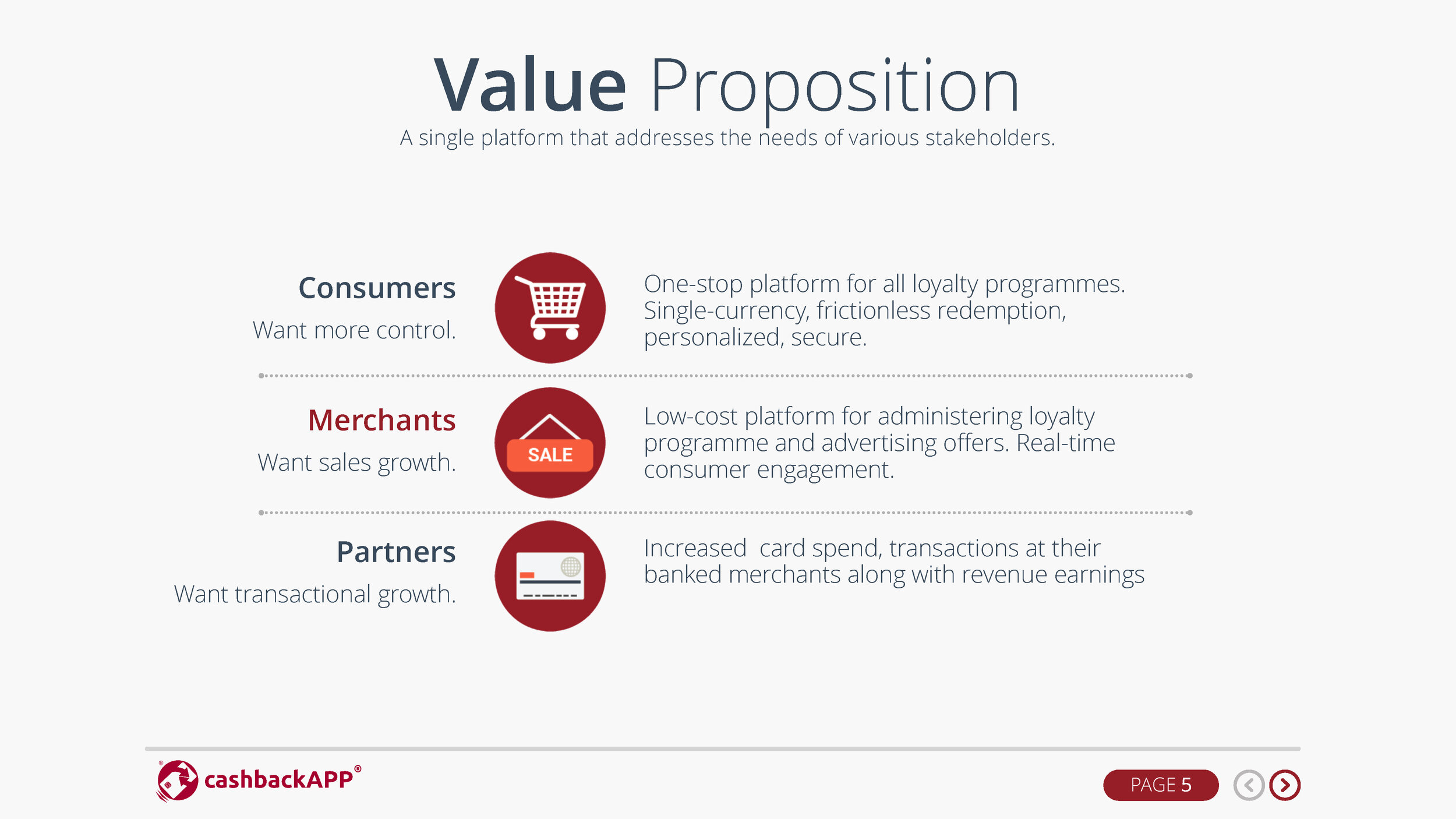

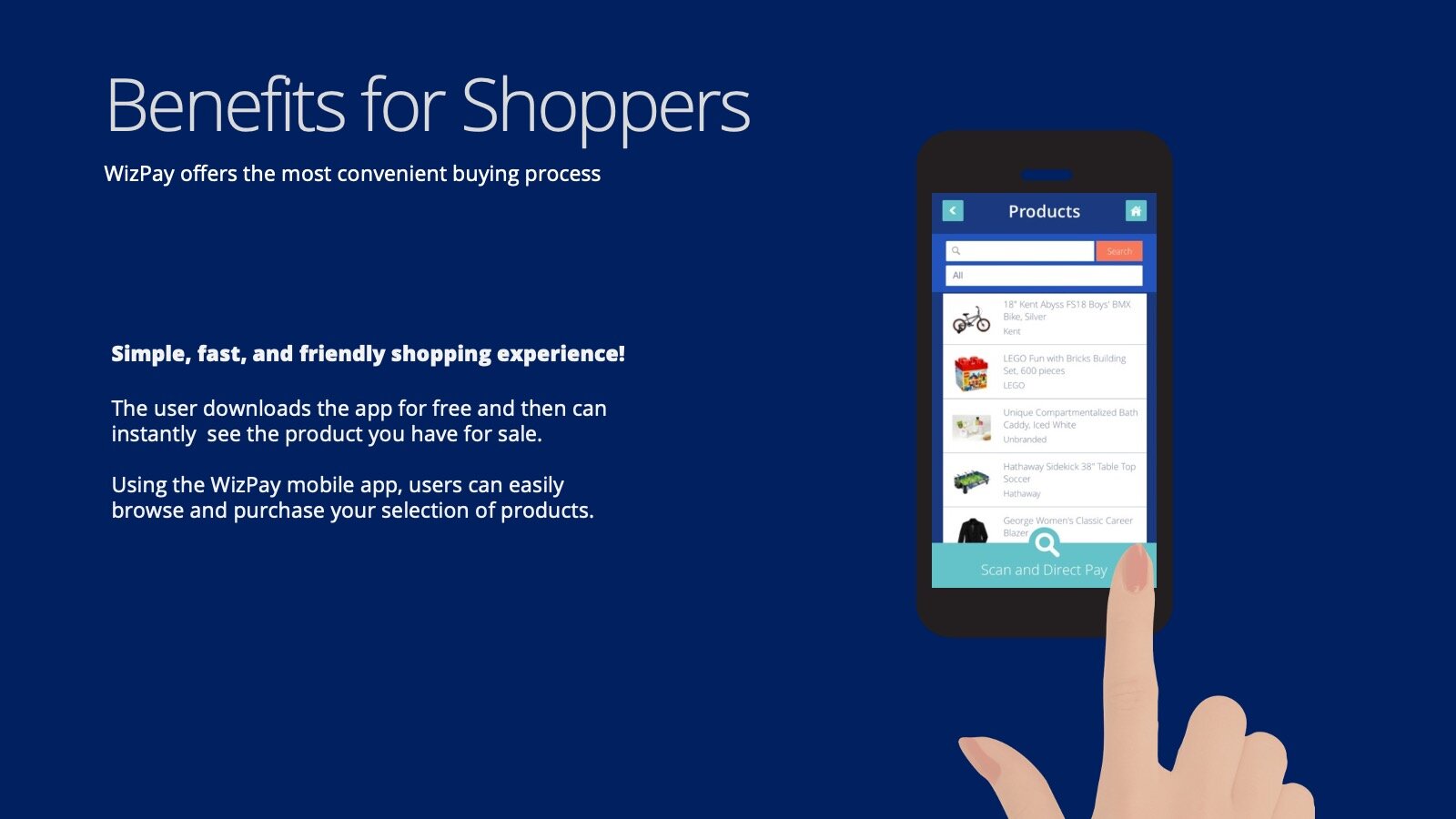

Custom Pitch Decks: We design compelling pitch decks that resonate with investors and partners, showcasing your fintech's unique value proposition, market opportunity, and growth potential.

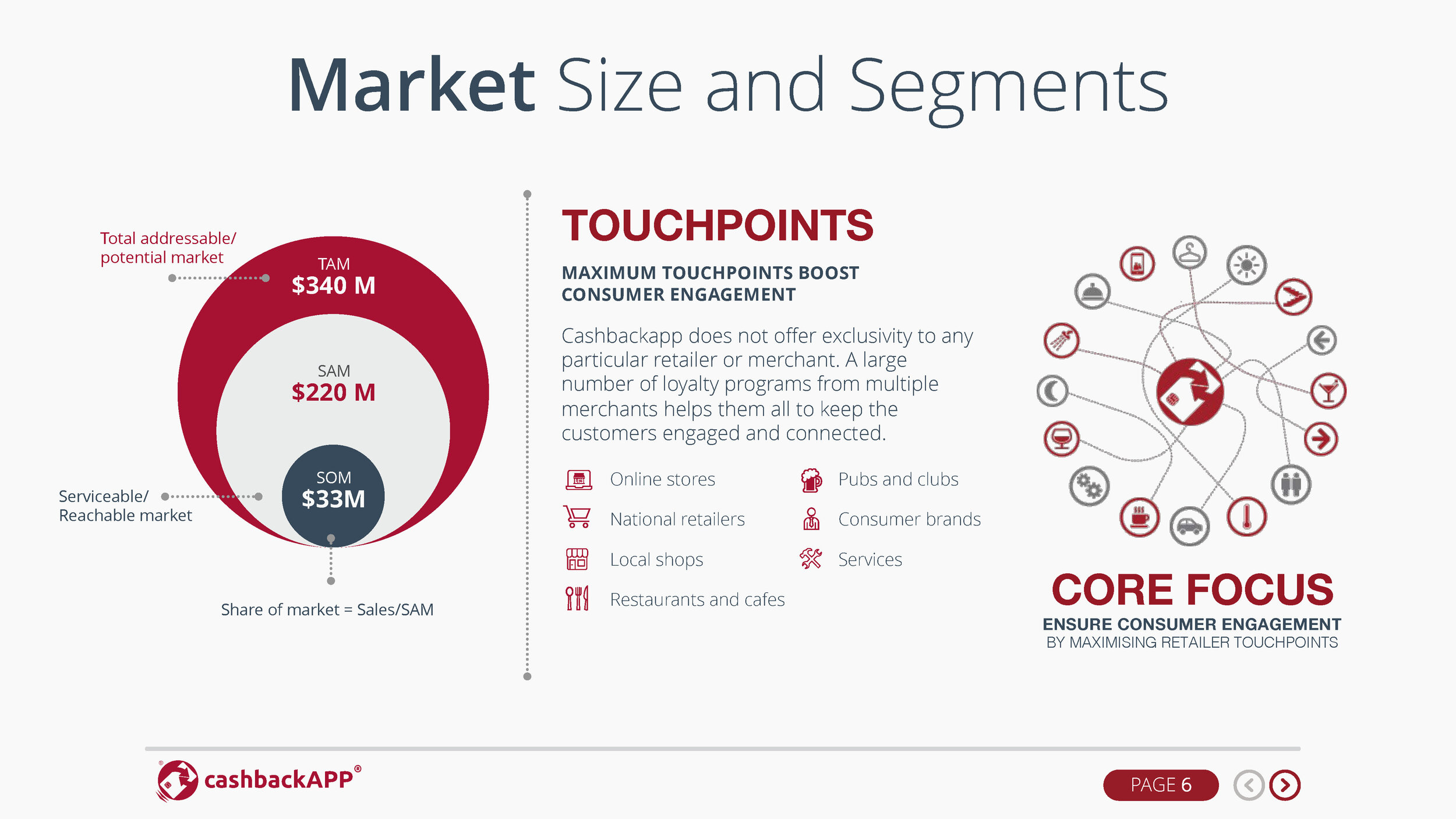

In-Depth Market Research: Our team conducts thorough market research to identify trends, analyze the competitive landscape, and uncover insights that inform your business strategy.

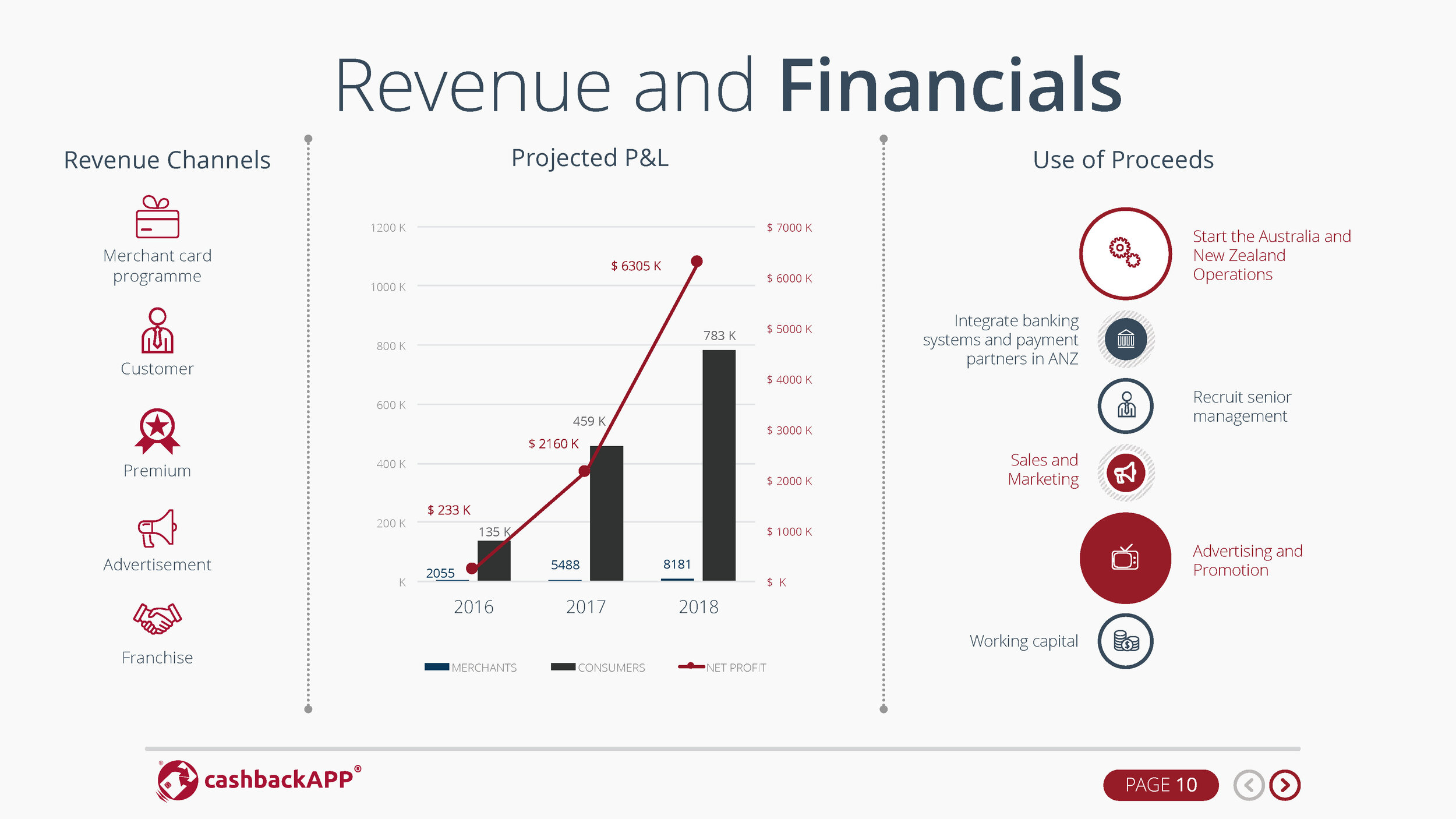

Comprehensive Financials: We provide financial modeling and projections, allowing you to make data-driven decisions and secure funding with confidence.

Partner with us to elevate your fintech venture to new heights. Contact us today to learn how our tailored solutions can help you succeed in this dynamic and ever-growing industry.

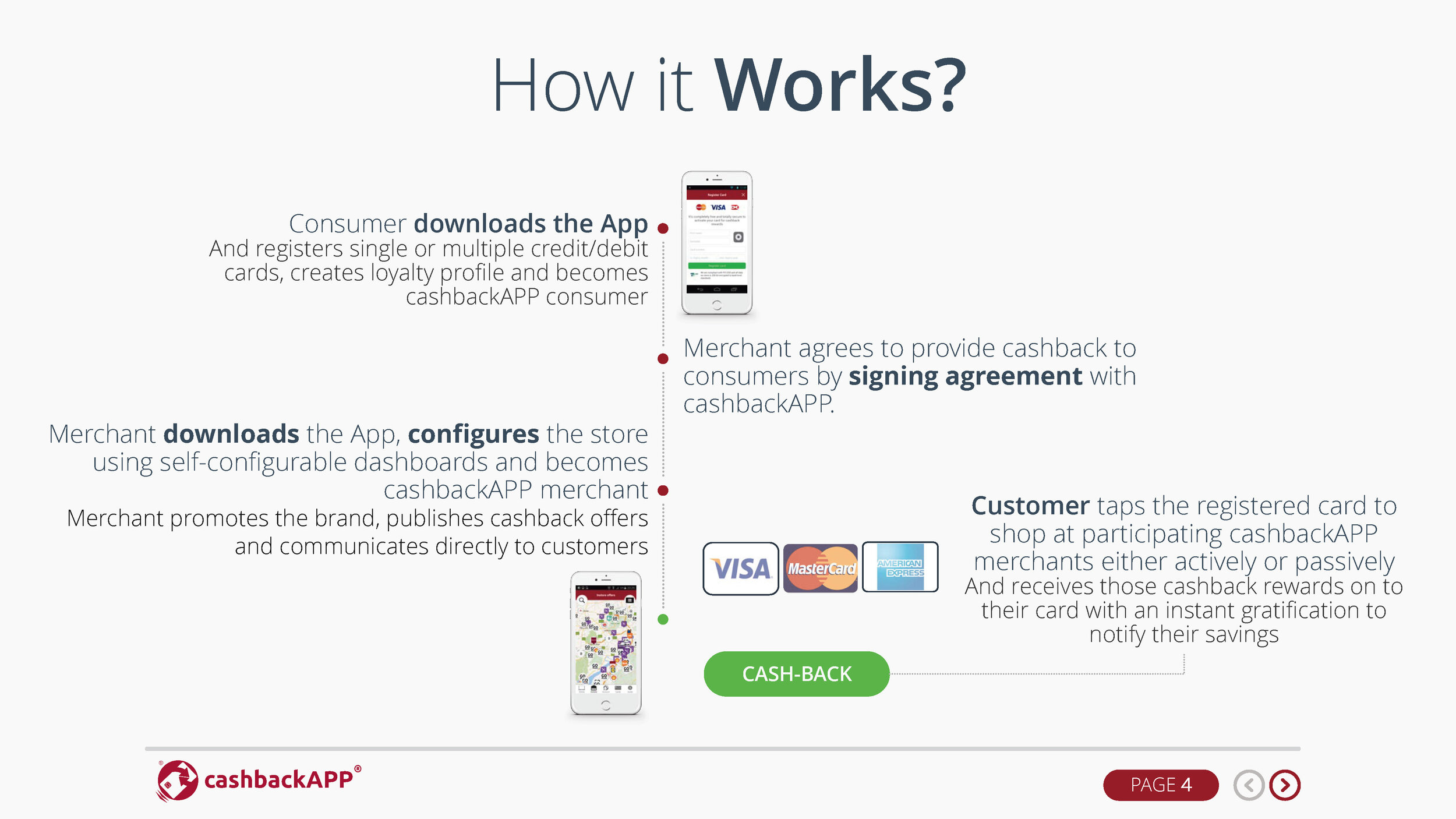

Success Stories

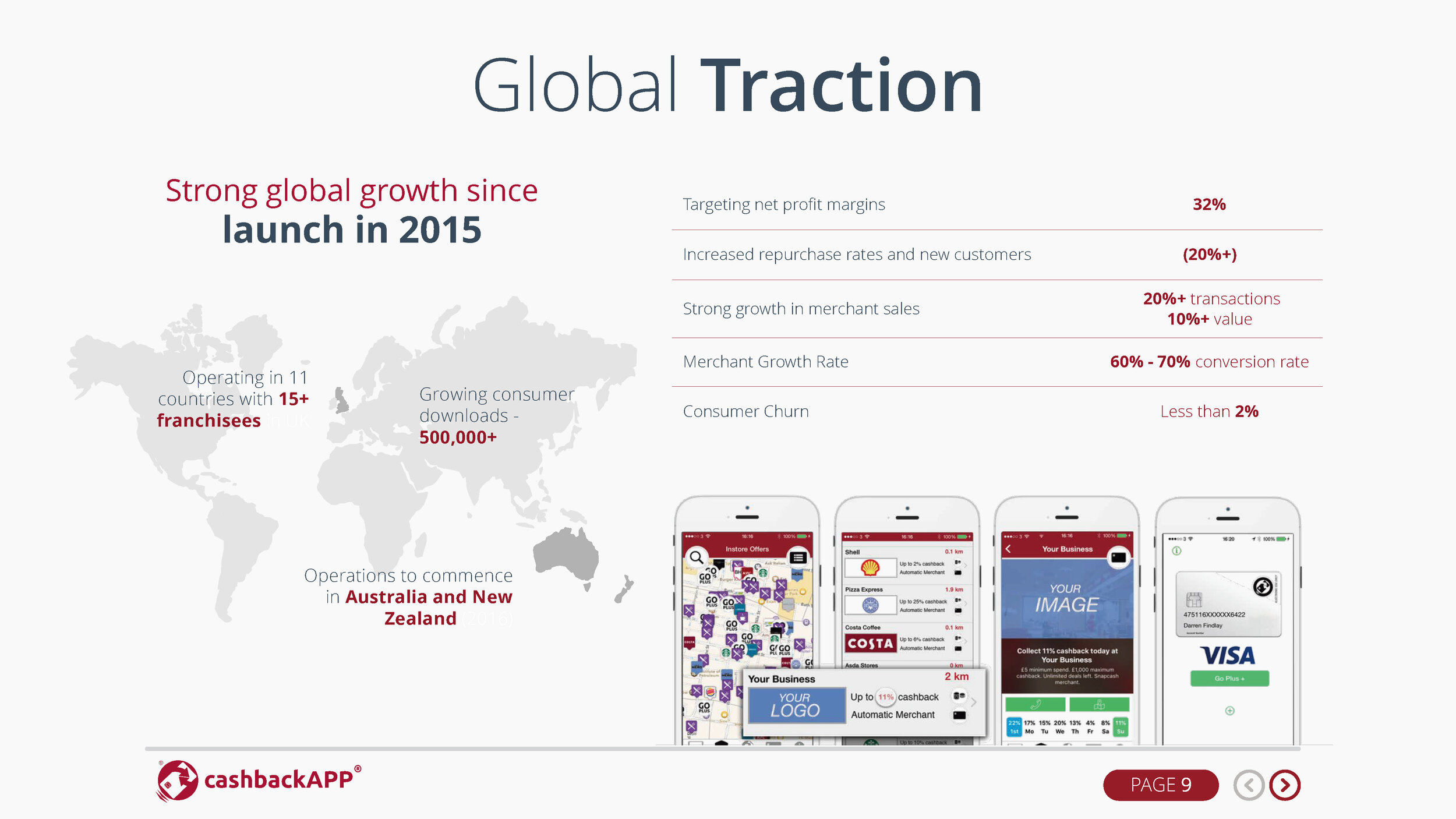

At aPitchDeck.com, we take pride in our successful track record of helping fintech startups achieve their funding goals and grow their businesses. Our customized solutions have empowered our clients to stand out in a highly competitive industry, securing investments and partnerships. Here are some of our notable success stories, showcasing our expertise in creating effective pitch decks, conducting market research, and delivering financial solutions that cater to the unique needs of the fintech industry.